VENTURE INVESTMENT ASSOCIATES' heritage places it as one of the most established, experienced, and most successful private equity fund investors.

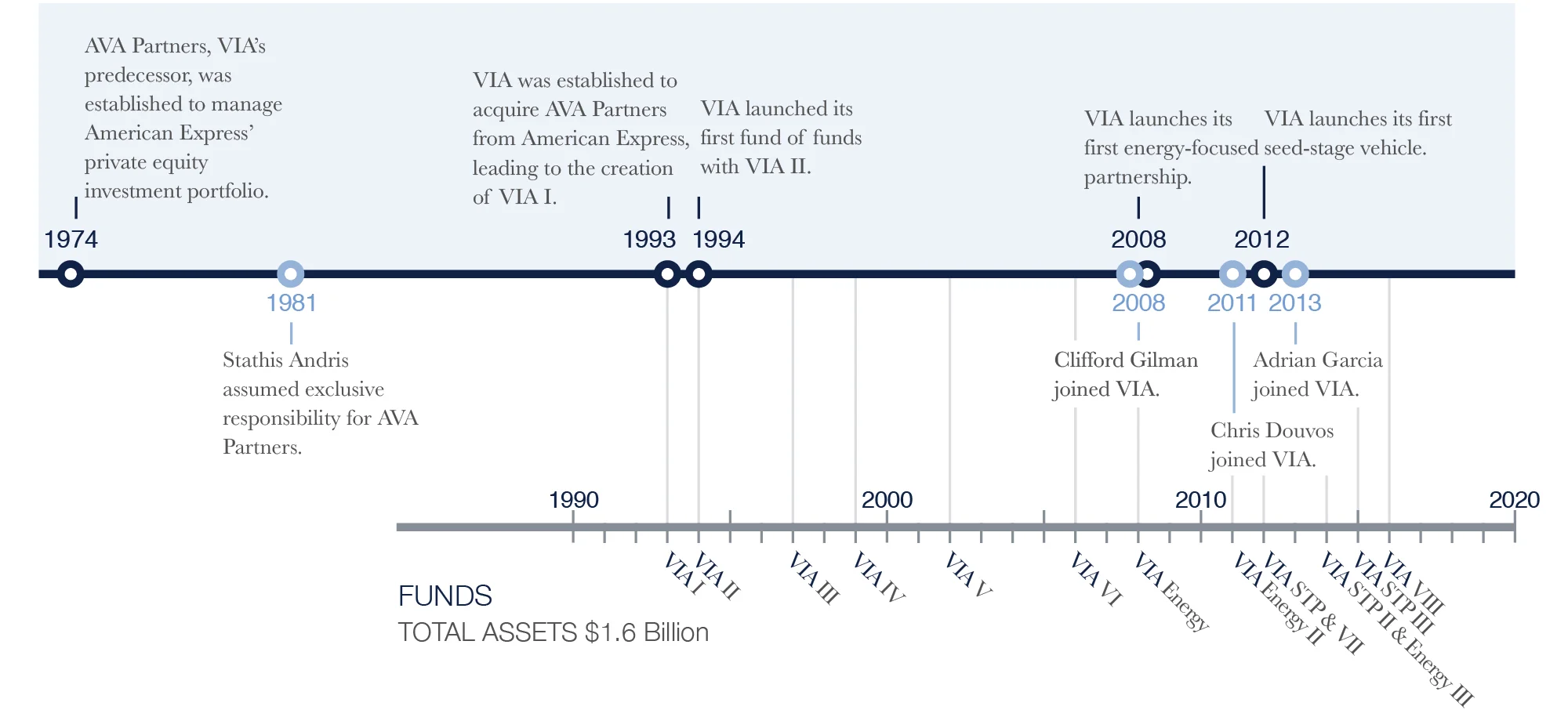

Stathis Andris, VIA’s founder and chairman, was one of the earliest investors in private equity and venture capital. He founded VIA in 1993 to acquire AVA Partners (AVA), the private equity portfolio of the American Express Company, a $180 million portfolio he developed during 20 years while employed by American Express. At the time, AVA's purchase was the largest secondary acquisition of a private equity portfolio.

AVA was a pioneering venture capital investor in the late 1960's, when the famed Reid Dennis, an employee of American Express, began investing in startup companies in what came to be known as Silicon Valley. Stathis led AVA's first venture capital fund commitment in 1974 to IVA (Reid's first independent fund), and in its first buyout fund commitment to KKR in 1976. In 1994, VIA turned its focus to a fund of funds investment model, so that it could continue to invest with some of the best firms in private equity.

VIA continues to evolve its strategy to address the dynamic markets in which it invests. In 2013, energy investor Adrian Garcia joined VIA to establish the Houston office and lead the firm’s investment in oil and gas opportunities.

To date, VIA has raised 18 funds with more than $1.6B under management.